Page 138 - NovDefComp

P. 138

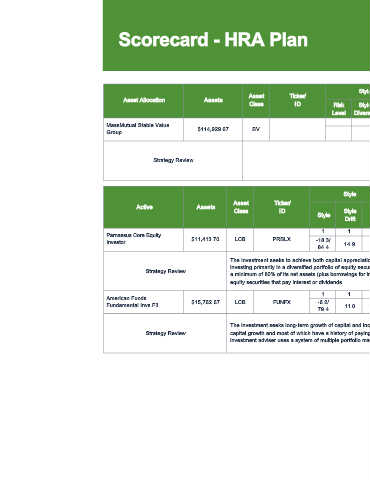

Scorecard - HRA Plan

Style Risk/Return Peer Group Qual Score

Asset Ticker/

Asset Allocation Assets

Class I D Risk Style Risk/ Up/ Info Return Q3 Q2 Q1 Q4

R 2 SR Rank 2pt Max

Level Diversity Return Down Ratio Rank 2020 2020 2020 2019

- - - -

MassMutual Stable Value

$114,929.67 SV

Group - - - -

Strategy Review

Style Risk/Return Peer Group Qual Score

Asset Ticker/

Active Assets Info

Class I D Style 2 Risk/ Up/ Info Return Q3 Q2

Style R Ratio 2pt Max Q1 2020 Q4 2019

Drift Return Down Ratio Rank 2020 2020

Rank

1 1 1 1 1 0 1 1 2 9 10 10 9

Parnassus Core Equity

$11,413.70 LCB PRBLX -18.3/ 13.0/ 87.1/

Investor 14.9 94.1 -0.04 12.0 14.0 LCB LCB LCB LCB

84.4 13.9 79.4

The investment seeks to achieve both capital appreciation and current income. The fund's objective is to achieve both capital appreciation and current income by

investing primarily in a diversified portfolio of equity securities. Equity securities include common and preferred stock. Under normal circumstances, the fund will invest

Strategy Review

a minimum of 80% of its net assets (plus borrowings for investment purposes) in equity securities. At least 75% of the fund's total assets will normally be invested in

equity securities that pay interest or dividends.

1 1 1 1 0 0 1 1 2 8 8 8 10

American Funds

$15,762.67 LCB FUNFX -6.2/ 14.6/ 93.4/

Fundamental Invs F3 11.0 96.6 -0.47 34.0 33.0 LCB LCB LCB LCB

79.4 12.8 97.2

The investment seeks long-term growth of capital and income. The fund invests primarily in common stocks of companies that appear to offer superior opportunities for

Strategy Review capital growth and most of which have a history of paying dividends. It may invest significantly in securities of issuers domiciled outside the United States. The

investment adviser uses a system of multiple portfolio managers in managing the fund's assets.

47