Page 140 - NovDefComp

P. 140

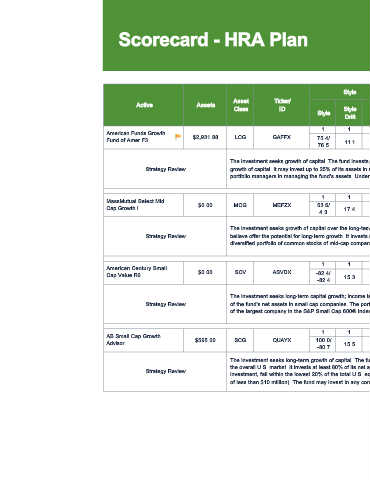

Scorecard - HRA Plan

Style Risk/Return Peer Group Qual Score

Asset Ticker/

Active Assets Info

Class I D Style Risk/ Up/ Info Return Q3

Style R 2 Ratio 2pt Max Q2 2020 Q1 2020 Q4 2019

Drift Return Down Ratio Rank 2020

Rank

1 1 1 1 0 0 0 0 2 6 6 8 8

American Funds Growth

$2,931.88 LCG GAFFX 75.4/ 15.6/ 90.2/

Fund of Amer F3 11.1 95.0 -0.84 66.0 64.0 LCG LCG LCG LCG

76.5 17.1 98.9

The investment seeks growth of capital. The fund invests primarily in common stocks and seeks to invest in companies that appear to offer superior opportunities for

Strategy Review growth of capital. It may invest up to 25% of its assets in securities of issuers domiciled outside the United States. The investment adviser uses a system of multiple

portfolio managers in managing the fund's assets. Under this approach, the portfolio of the fund is divided into segments managed by individual managers.

1 1 1 1 0 0 1 1 2 8 8 8 10

MassMutual Select Mid

$0.00 MCG MEFZX 53.6/ 16.8/ 92.7/

Cap Growth I 17.4 97.1 -0.58 45.0 46.0 MCG MCG MCG MCG

4.3 13.8 97.6

The investment seeks growth of capital over the long-term. The fund invests primarily in equity securities of mid-capitalization companies that the fund's subadvisers

Strategy Review believe offer the potential for long-term growth. It invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in a broadly

diversified portfolio of common stocks of mid-cap companies whose earnings the subadvisers expect to grow at a faster rate than the average company.

1 1 1 1 1 1 1 1 2 10 10 10 10

American Century Small

$0.00 SCV ASVDX -82.4/ 21.6/ 104.7/

Cap Value R6 15.3 96.0 0.41 15.0 12.0 SCV SCV SCV SCV

-82.4 5.9 97.9

The investment seeks long-term capital growth; income is a secondary consideration. Under normal market conditions, the portfolio managers will invest at least 80%

Strategy Review of the fund's net assets in small cap companies. The portfolio managers consider small cap companies to include those with market capitalizations no larger than that

of the largest company in the S&P Small Cap 600® Index or the Russell 2000® Index.

1 1 1 1 1 1 1 1 2 10 10 10 10

AB Small Cap Growth

$595.20 SCG QUAYX 100.0/ 20.8/ 118.0/

Advisor 15.5 94.0 1.7 5.0 5.0 SCG SCG SCG SCG

-80.7 20.0 87.9

The investment seeks long-term growth of capital. The fund invests primarily in a diversified portfolio of equities with relatively smaller capitalizations as compared to

the overall U.S. market. It invests at least 80% of its net assets in equities of smaller companies. For these purposes, "smaller companies" are those that, at the time of

Strategy Review

investment, fall within the lowest 20% of the total U.S. equity market capitalization (excluding, for purposes of this calculation, companies with market capitalizations

of less than $10 million). The fund may invest in any company and industry and in any type of equity security with potential for capital appreciation.

48