Page 25 - NovDefComp

P. 25

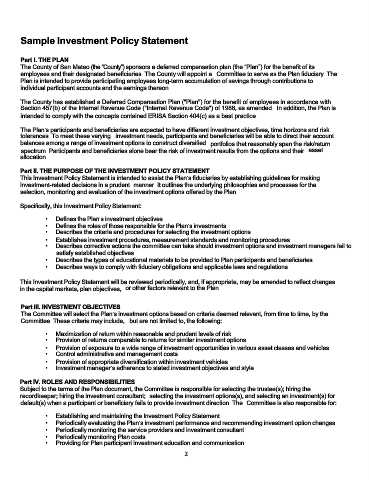

Sample Investment Policy Statement

Part I. THE PLAN

The County of San Mateo (the “County”) sponsors a deferred compensation plan (the “Plan”) for the benefit of its

employees and their designated beneficiaries. The County will appoint a Committee to serve as the Plan fiduciary. The

Plan is intended to provide participating employees long-term accumulation of savings through contributions to

individual participant accounts and the earnings thereon.

The County has established a Deferred Compensation Plan ("Plan") for the benefit of employees in accordance with

Section 457(b) of the Internal Revenue Code ("Internal Revenue Code") of 1986, as amended. In addition, the Plan is

intended to comply with the concepts contained ERISA Section 404(c) as a best practice.

The Plan’s participants and beneficiaries are expected to have different investment objectives, time horizons and risk

tolerances. To meet these varying investment needs, participants and beneficiaries will be able to direct their account

balances among a range of investment options to construct diversified portfolios that reasonably span the risk/return

spectrum. Participants and beneficiaries alone bear the risk of investment results from the options and their asset

allocation.

Part II. THE PURPOSE OF THE INVESTMENT POLICY STATEMENT

This Investment Policy Statement is intended to assist the Plan’s fiduciaries by establishing guidelines for making

investment-related decisions in a prudent manner. It outlines the underlying philosophies and processes for the

selection, monitoring and evaluation of the investment options offered by the Plan.

Specifically, this Investment Policy Statement:

• Defines the Plan’s investment objectives.

• Defines the roles of those responsible for the Plan’s investments.

• Describes the criteria and procedures for selecting the investment options.

• Establishes investment procedures, measurement standards and monitoring procedures.

• Describes corrective actions the committee can take should investment options and investment managers fail to

satisfy established objectives.

• Describes the types of educational materials to be provided to Plan participants and beneficiaries.

• Describes ways to comply with fiduciary obligations and applicable laws and regulations.

This Investment Policy Statement will be reviewed periodically, and, if appropriate, may be amended to reflect changes

in the capital markets, plan objectives, or other factors relevant to the Plan.

Part III. INVESTMENT OBJECTIVES

The Committee will select the Plan’s investment options based on criteria deemed relevant, from time to time, by the

Committee. These criteria may include, but are not limited to, the following:

• Maximization of return within reasonable and prudent levels of risk.

• Provision of returns comparable to returns for similar investment options.

• Provision of exposure to a wide range of investment opportunities in various asset classes and vehicles.

• Control administrative and management costs.

• Provision of appropriate diversification within investment vehicles.

• Investment manager’s adherence to stated investment objectives and style.

Part IV. ROLES AND RESPONSIBILITIES

Subject to the terms of the Plan document, the Committee is responsible for selecting the trustee(s); hiring the

recordkeeper; hiring the investment consultant; selecting the investment options(s), and selecting an investment(s) for

default(s) when a participant or beneficiary fails to provide investment direction. The Committee is also responsible for:

• Establishing and maintaining the Investment Policy Statement.

• Periodically evaluating the Plan’s investment performance and recommending investment option changes.

• Periodically monitoring the service providers and investment consultant.

• Periodically monitoring Plan costs.

• Providing for Plan participant investment education and communication.

2