Page 32 - NovDefComp

P. 32

Scorecard System Methodology™

The Scorecard System Methodology incorporates both quantitative and qualitative factors in evaluating fund managers and their investment

strategies. The Scorecard System is built around pass/fail criteria, on a scale of 0 to 10 (with 10 being the best) and has the ability to measure active,

passive and asset allocation investing strategies. Active and asset allocation strategies are evaluated over a five-year time period, and passive

strategies are evaluated over a three-year time period.

Eighty percent of the fund’s score is quantitative (made up of eight unique factors), incorporating modern portfolio theory statistics, quadratic

optimization analysis, and peer group rankings (among a few of the quantitative factors). The other 20 percent of the score is qualitative, taking into

account things such as manager tenure, the fund’s expense ratio relative to the average fund expense ratio in that asset class category, and the fund’s

strength of statistics (statistical significance). Other criteria that may be considered in the qualitative score includes the viability of the firm managing the

assets, management or personnel issues at the firm, and/or whether there has been a change in direction of the fund’s stated investment strategy. The

following pages detail the specific factors for each type of investing strategies.

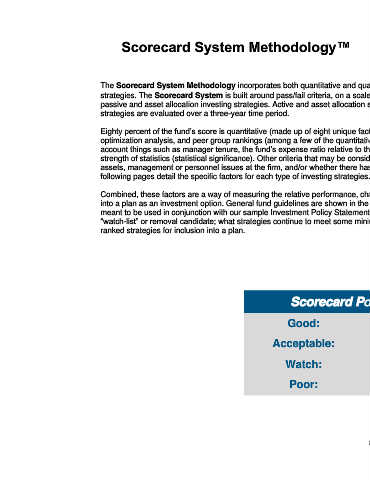

Combined, these factors are a way of measuring the relative performance, characteristics, behavior and overall appropriateness of a fund for inclusion

into a plan as an investment option. General fund guidelines are shown in the “Scorecard Point System” table below. The Scorecard Point System is

meant to be used in conjunction with our sample Investment Policy Statement, in order to help identify what strategies need to be discussed as a

“watch-list” or removal candidate; what strategies continue to meet some minimum standards and continue to be appropriate; and/or identify new top-

ranked strategies for inclusion into a plan.

Scorecard Point System

Good: 9-10 Points

Acceptable: 7-8 Points

Watch: 5-6 Points

Poor: 0-4 Points

8