Page 34 - NovDefComp

P. 34

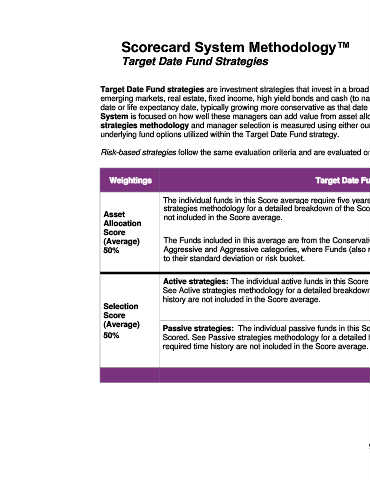

Scorecard System Methodology™

Target Date Fund Strategies

Target Date Fund strategies are investment strategies that invest in a broad array of asset classes that may include U.S. equity, international equity,

emerging markets, real estate, fixed income, high yield bonds and cash (to name a few asset classes). These strategies are managed to a retirement

date or life expectancy date, typically growing more conservative as that date is approached. For this type of investment strategy, the Scorecard

System is focused on how well these managers can add value from asset allocation. Asset allocation is measured using our Asset allocation

strategies methodology and manager selection is measured using either our Active and/or Passive strategies methodologies, depending on the

underlying fund options utilized within the Target Date Fund strategy.

Risk-based strategies follow the same evaluation criteria and are evaluated on both their asset allocation and security selection.

Maximum

Weightings Target Date Fund Strategies

Points

The individual funds in this Score average require five years of time history to be included. See Asset Allocation

strategies methodology for a detailed breakdown of the Scoring criteria. Funds without the required time history are

Asset not included in the Score average.

Allocation 5

Score

(Average) The Funds included in this average are from the Conservative, Moderate Conservative, Moderate, Moderate

50% Aggressive and Aggressive categories, where Funds (also referred to as “vintages”) are individually Scored according

to their standard deviation or risk bucket.

Active strategies: The individual active funds in this Score average require five years of time history to be Scored.

See Active strategies methodology for a detailed breakdown of the Scoring criteria. Funds without the required time

history are not included in the Score average.

Selection

Score

(Average) Passive strategies: The individual passive funds in this Score average require three years of time history to be 5

50% Scored. See Passive strategies methodology for a detailed breakdown of the Scoring criteria. Funds without the

required time history are not included in the Score average.

Total 10

9