Page 38 - NovDefComp

P. 38

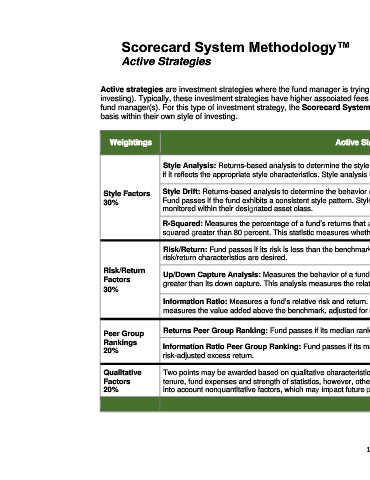

Scorecard System Methodology™

Active Strategies

Active strategies are investment strategies where the fund manager is trying to add value and outperform the market averages (for that style of

investing). Typically, these investment strategies have higher associated fees due to the active involvement in the portfolio management process by the

fund manager(s). For this type of investment strategy, the Scorecard System is trying to identify those managers who can add value on a consistent

basis within their own style of investing.

Maximum

Weightings Active Strategies

Points

Style Analysis: Returns-based analysis to determine the style characteristics of a fund over a period of time. Fund passes 1

if it reflects the appropriate style characteristics. Style analysis helps ensure proper diversification in the Plan.

Style Factors Style Drift: Returns-based analysis to determine the behavior of the fund/manager over multiple (rolling) time periods.

30% Fund passes if the fund exhibits a consistent style pattern. Style consistency is desired so that funds can be effectively 1

monitored within their designated asset class.

R-Squared: Measures the percentage of a fund’s returns that are explained by the benchmark. Fund passes with an R- 1

squared greater than 80 percent. This statistic measures whether the benchmark used in the analysis is appropriate.

Risk/Return: Fund passes if its risk is less than the benchmark or its return is greater than the benchmark. Favorable 1

risk/return characteristics are desired.

Risk/Return

Factors Up/Down Capture Analysis: Measures the behavior of a fund in up and down markets. Fund passes with an up capture 1

greater than its down capture. This analysis measures the relative value by the manager in up and down markets.

30%

Information Ratio: Measures a fund’s relative risk and return. Fund passes if ratio is greater than 0. This statistic 1

measures the value added above the benchmark, adjusted for risk.

th 1

Peer Group Returns Peer Group Ranking: Fund passes if its median rank is above the 50 percentile.

Rankings th

20% Information Ratio Peer Group Ranking: Fund passes if its median rank is above the 50 percentile. This ranking ranks 1

risk-adjusted excess return.

Qualitative Two points may be awarded based on qualitative characteristics of the fund. Primary considerations are given to manager

Factors tenure, fund expenses and strength of statistics, however, other significant factors may be considered. It is important to take 2

20% into account nonquantitative factors, which may impact future performance.

Total 10

11