Page 101 - AugDefComp

P. 101

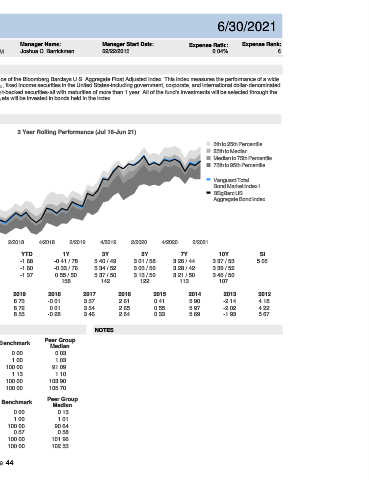

Vanguard Total Bond Market Index I VBTIX 6/30/2021

Fund Incep Date: Benchmark: Category: Net Assets: Manager Name: Manager Start Date: Expense Ratio: Expense Rank:

09/18/1995 BBgBarc US Aggregate Bond Index Intermediate Core Bond $312,151.00M Joshua C. Barrickman 02/22/2013 0.04% 6

PORTFOLIO COMPOSITION (Holdings-based) INVESTMENT OVERVIEW

Assets The investment seeks to track the performance of the Bloomberg Barclays U.S. Aggregate Float Adjusted Index. This index measures the performance of a wide

spectrum of public, investment-grade, taxable, fixed income securities in the United States-including government, corporate, and international dollar-denominated

Cash 0.14% bonds, as well as mortgage-backed and asset-backed securities-all with maturities of more than 1 year. All of the fund's investments will be selected through the

US Stocks 0.00% sampling process, and at least 80% of its assets will be invested in bonds held in the index.

US Bonds 91.35%

Non-US Stocks 0.00%

Preferred Stocks 0.00% PERFORMANCE

Convertible Bonds 0.84%

Other 0.00% 3 Year Rolling Performance (Jul 16-Jun 21)

Non-US Bonds 7.68% 7

5th to 25th Percentile

6 25th to Median

Median to 75th Percentile

Credit Quality (%) 5 75th to 95th Percentile

AAA 68.56%

AA 3.07% 4 Vanguard Total

Bond Market Index I

A 12.18%

BBB 16.09% 3 BBgBarc US

Aggregate Bond Index

BB 0.00%

B 0.00% 2

Below B 0.01%

NR/NA 0.09% 1

Total: 100.00%

0

4/2016 2/2017 4/2017 2/2018 4/2018 2/2019 4/2019 2/2020 4/2020 2/2021

3M YTD 1Y 3Y 5Y 7Y 10Y SI

Fund 2.00 -1.68 -0.41 / 78 5.40 / 49 3.01 / 58 3.26 / 44 3.37 / 53 5.05

Sector (%)

Benchmark 1.83 -1.60 -0.33 / 76 5.34 / 52 3.03 / 56 3.28 / 42 3.39 / 52

% Government 46.90%

% Municipal 0.73% Peer Group Median 1.86 -1.37 0.55 / 50 5.37 / 50 3.13 / 50 3.21 / 50 3.45 / 50

% Corporate 28.82% Number of Funds 158 142 122 113 107

% Securitized 23.41% CALENDAR 2020 2019 2018 2017 2016 2015 2014 2013 2012

% Cash and Equivalent 0.14% Fund 7.74 8.73 -0.01 3.57 2.61 0.41 5.90 -2.14 4.18

% Derivative 0.00%

Benchmark 7.51 8.72 0.01 3.54 2.65 0.55 5.97 -2.02 4.22

Total: 100.00%

Peer Group Median 7.65 8.55 -0.28 3.46 2.64 0.33 5.69 -1.93 5.67

RISK & PERFORMANCE STATISTICS NOTES

Peer Group

3 Yr Fund Benchmark

ASSET LOADINGS (Returns-based) Median

Alpha -0.10 0.00 0.03

FUND EXPOSURES (WEIGHT) (Jul 18-Jun 21) Beta 1.04 1.00 1.03

100

75 R-Squared 99.20 100.00 91.09

Sharpe Ratio 1.10 1.13 1.10

50

25 Up Market Capture 102.43 100.00 103.90

0 Down Market Capture 105.20 100.00 105.70

Current Average

Fund Bmk Fund Bmk 5 Yr Fund Benchmark Peer Group

Cash 0.9 1.4 5.7 1.3 Median

Credit Bond 29.6 29.9 30.3 30.0 Alpha -0.09 0.00 0.15

Govt Bond 50.1 42.2 50.0 41.9 Beta 1.04 1.00 1.01

HY Corp Bond 0.8 0.2 0.2 0.1 R-Squared 99.16 100.00 90.64

MBS 14.8 24.7 10.1 25.2 Sharpe Ratio 0.55 0.57 0.58

Muni Bond 3.8 1.3 3.8 1.3 Up Market Capture 101.99 100.00 101.96

TIPS 0.0 0.2 0.1 0.2 Down Market Capture 104.50 100.00 102.53

Page 44