Page 103 - AugDefComp

P. 103

PIMCO Total Return Instl PTTRX 6/30/2021

Fund Incep Date: Benchmark: Category: Net Assets: Manager Name: Manager Start Date: Expense Ratio: Expense Rank:

05/11/1987 BBgBarc US Aggregate Bond Index Intermediate Core-Plus Bond $69,181.00M Mark R. Kiesel 09/26/2014 0.70% 73

PORTFOLIO COMPOSITION (Holdings-based) INVESTMENT OVERVIEW

Assets The investment seeks maximum total return, consistent with preservation of capital and prudent investment management. The fund invests at least 65% of its

total assets in a diversified portfolio of Fixed Income Instruments of varying maturities, which may be represented by forwards or derivatives such as options,

Cash 23.80% futures contracts, or swap agreements. It invests primarily in investment-grade debt securities, but may invest up to 20% of its total assets in high yield securities.

US Stocks 0.00% It may invest up to 30% of its total assets in securities denominated in foreign currencies, and may invest beyond this limit in U.S. dollar-denominated securities of

US Bonds 44.44% foreign issuers.

Non-US Stocks 0.00%

Preferred Stocks 0.46% PERFORMANCE

Convertible Bonds 1.29%

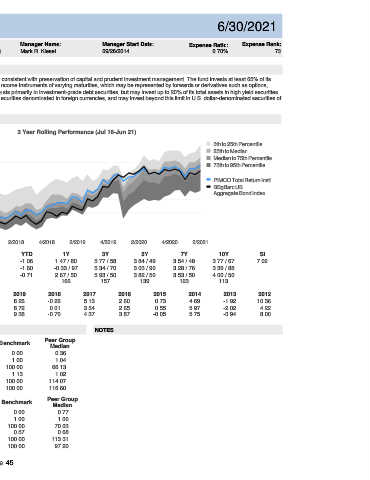

Other 2.65% 3 Year Rolling Performance (Jul 16-Jun 21)

Non-US Bonds 27.37% 8

5th to 25th Percentile

7 25th to Median

Median to 75th Percentile

6 75th to 95th Percentile

Credit Quality (%)

AAA 5

AA PIMCO Total Return Instl

A 4 BBgBarc US

Aggregate Bond Index

BBB

BB 3

B

2

Below B

NR/NA 1

Total: 0.00%

0

4/2016 2/2017 4/2017 2/2018 4/2018 2/2019 4/2019 2/2020 4/2020 2/2021

3M YTD 1Y 3Y 5Y 7Y 10Y SI

Fund 2.09 -1.06 1.47 / 80 5.77 / 58 3.84 / 49 3.54 / 48 3.77 / 67 7.02

Sector (%)

Benchmark 1.83 -1.60 -0.33 / 97 5.34 / 70 3.03 / 90 3.28 / 76 3.39 / 88

% Government 32.66%

% Municipal 0.31% Peer Group Median 2.12 -0.71 2.67 / 50 5.93 / 50 3.82 / 50 3.53 / 50 4.00 / 50

% Corporate 16.96% Number of Funds 166 157 139 123 113

% Securitized 20.83% CALENDAR 2020 2019 2018 2017 2016 2015 2014 2013 2012

% Cash and Equivalent 13.30% Fund 8.88 8.26 -0.26 5.13 2.60 0.73 4.69 -1.92 10.36

% Derivative 15.93%

Benchmark 7.51 8.72 0.01 3.54 2.65 0.55 5.97 -2.02 4.22

Total: 99.99%

Peer Group Median 8.33 9.38 -0.70 4.37 3.87 -0.05 5.75 -0.94 8.00

RISK & PERFORMANCE STATISTICS NOTES

Peer Group

3 Yr Fund Benchmark

ASSET LOADINGS (Returns-based) Median

Alpha 0.50 0.00 0.36

FUND EXPOSURES (WEIGHT) (Jul 18-Jun 21) Beta 0.98 1.00 1.04

100

75 R-Squared 88.82 100.00 66.13

Sharpe Ratio 1.22 1.13 1.02

50

25 Up Market Capture 104.02 100.00 114.07

0 Down Market Capture 95.83 100.00 116.60

Current Average

Fund Bmk Fund Bmk 5 Yr Fund Benchmark Peer Group

Cash 2.0 1.4 9.2 1.3 Median

Credit Bond 30.6 29.9 26.5 30.0 Alpha 0.82 0.00 0.77

Govt Bond 31.0 42.2 39.7 41.9 Beta 0.99 1.00 1.00

HY Corp Bond 0.4 0.2 2.5 0.1 R-Squared 89.60 100.00 70.03

MBS 13.8 24.7 3.5 25.2 Sharpe Ratio 0.80 0.57 0.68

Muni Bond 9.6 1.3 8.8 1.3 Up Market Capture 108.52 100.00 113.31

TIPS 12.6 0.2 9.9 0.2 Down Market Capture 89.76 100.00 97.20

Page 45