Page 25 - AugDefComp

P. 25

Market Overview 6/30/2021

Fixed Income Snapshot

FIXED INCOME

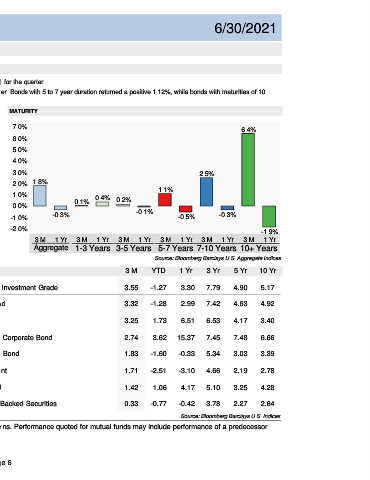

The broad U.S. fixed income market returned a positive 1.83% (Bloomberg Barclays U.S Aggregate) for the quarter.

On the maturity side, bonds with 1 to 3 year maturities returned a positive 0.05% return for the quarter. Bonds with 5 to 7 year duration returned a positive 1.12%, while bonds with maturities of 10

years or more posted a positive 6.44%.

QUALITY MATURITY

15.4%

16.0% 15.4% 7.0% 6.4%

6.4%

14.0% 6.0%

12.0% 5.0%

10.0% 4.0%

8.0% 3.0% 2.5%

2.5%

1.8%

5.5%

6.0% 5.5% 2.0% 1.8%

4.7% 1.1%

4.7%

1.1%

3.8%

3.6%

3.2%

4.0% 3.6% 3.2% 3.8% 1.0%

2.7% 0.1% 0.4% 0.2%

0.4%

2.7%

0.2%

0.1%

1.4%

2.0% 1.4% 0.0%

0.6% -0.1%

0.6%

-0.1%

-0.3%

-0.3%

-0.5%

0.0% -1.0% -0.3% -0.5% -0.3%

-0.5%

-0.5%

-2.0% -2.0% -1.9%

-1.9%

_________ _________ _________ _________ _________ _________ _____________________________________________

1 Yr

1 Yr

3 M

3 M

3 M

1 Yr

3 M

1 Yr

3 M

3 M

1 Yr

1 Yr

3 M

3 M

1 Yr

3 M

1 Yr

1 Yr

1 Yr

3 M

3 M

1 Yr

Aaa Aa A Baa High Yield Aggregate 1-3 Years 3-5 Years 5-7 Years 7-10 Years 10+ Years

Source: Bloomberg Barclays U.S. Corporate Indices. Source: Bloomberg Barclays U.S. Aggregate Indices.

SECTOR (Sorted by trailing 3M performance) 3 M YTD 1 Yr 3 Yr 5 Yr 10 Yr

3.5% Corporate Investment Grade 3.55 -1.27 3.30 7.79 4.90 5.17

3.3%

3.3% Credit Bond 3.32 -1.28 2.99 7.42 4.63 4.92

3.0%

3.2% TIPS 3.25 1.73 6.51 6.53 4.17 3.40

6.5%

2.7% High Yield Corporate Bond 2.74 3.62 15.37 7.45 7.48 6.66

15.4%

1.8% Aggregate Bond 1.83 -1.60 -0.33 5.34 3.03 3.39

-0.3%

1.7% Government 1.71 -2.51 -3.10 4.66 2.19 2.78

-3.1%

1.4% Muni Bond 1.42 1.06 4.17 5.10 3.25 4.28

4.2%

0.3% Mortgage Backed Securities 0.33 -0.77 -0.42 3.78 2.27 2.64

-0.4%

-4.00 -2.00 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 16.00 Source: Bloomberg Barclays U.S. Indices.

Past performance is no guarantee of future results. Rankings provided based on total returns. Performance quoted for mutual funds may include performance of a predecessor

fund/share class prior to the share class commencement of operations.

Page 6