Page 150 - MayDefComp

P. 150

5/14/2020 Contract No. 061869-0001-0000

061869-0003-0000

Variable Return Investment

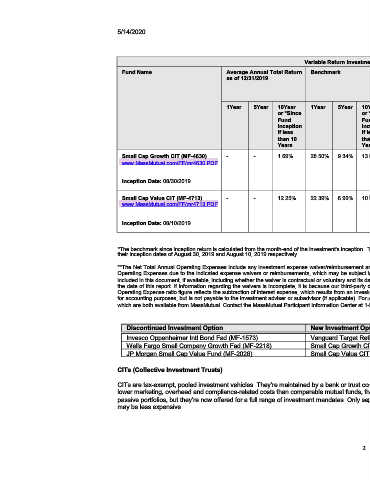

Fund Name Average Annual Total Return Benchmark Name of Gross Total Net Total Investment

as of 12/31/2019 Benchmark Annual Annual Close/

Operating Operating Open/

Expenses Expenses** Freeze

Date

1Year 5Year 10Year 1Year 5Year 10Year As a Per As a Per

or *Since or *Since % $1000 % $1000

Fund Fund

Inception Inception

if less if less

than 10 than 10

Years Years

Small Cap Growth CIT (MF-4630) - - 1.69% 28.50% 9.34% 13.01% Russell 0.59% $5.90 0.59% $5.90 This

www.MassMutual.com/FF/mr4630.PDF 2000® investment

Growth will be

Index available as

Inception Date: 08/30/2019 of

4/30/2020

Small Cap Value CIT (MF-4713) - - 12.25% 22.39% 6.99% 10.56% Russell 0.40% $4.00 0.40% $4.00 This

www.MassMutual.com/FF/mr4713.PDF 2000® investment

Value Idx will be

available as

Inception Date: 08/10/2019 of

4/30/2020

*The benchmark since inception return is calculated from the month-end of the investment's inception. The investment performance shown above for the Small Cap Growth CIT and Small Cap Value CIT is from

their inception dates of August 30, 2019 and August 10, 2019 respectively.

**The Net Total Annual Operating Expenses include any investment expense waiver/reimbursement arrangements documented in the investment’s prospectus and may be lower than the Gross Total Annual

Operating Expenses due to the indicated expense waivers or reimbursements, which may be subject to expiration. Additional information regarding investment expense waivers specific to each investment is

included in this document, if available, including whether the waiver is contractual or voluntary and its date of expiration. All available information about investment expense waivers is current and complete as of

the date of this report. If information regarding the waivers is incomplete, it is because our third-party data provider was unable to make the information available. For some investments, the Net Total Annual

Operating Expense ratio figure reflects the subtraction of interest expense, which results from an investment’s use of certain other investments. This expense is required to be treated as an investment expense

for accounting purposes, but is not payable to the investment adviser or subadvisor (if applicable). For more information, please see the investment profile or the prospectus that corresponds to the investment,

which are both available from MassMutual. Contact the MassMutual Participant Information Center at 1-888-606-7343.

Discontinued Investment Option New Investment Option

Invesco Oppenheimer Intl Bond Fad (MF-1573) Vanguard Target Retirement Fund Based on Age

Wells Fargo Small Company Growth Fad (MF-2218) Small Cap Growth CIT (MF-4630)

JP Morgan Small Cap Value Fund (MF-2026) Small Cap Value CIT (MF-4713)

CITs (Collective Investment Trusts)

CITs are tax-exempt, pooled investment vehicles. They’re maintained by a bank or trust company exclusively for qualified retirement plans and certain types of government plans. With

lower marketing, overhead and compliance-related costs than comparable mutual funds, they’re more economical for investors. Originally, plans used CITs mainly for stable-value and

passive portfolios, but they’re now offered for a full range of investment mandates. Only separately managed accounts, which require much higher asset minimums for most managers,

may be less expensive.

2 Exp 4/01/2021