Page 107 - AugDefComp

P. 107

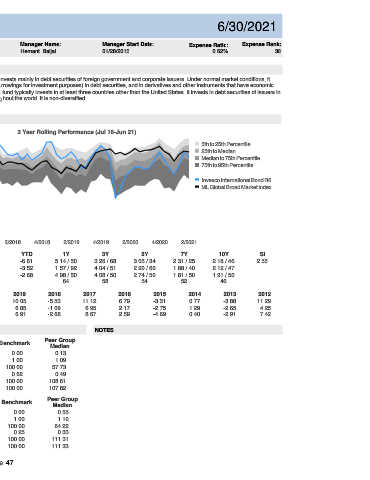

Invesco International Bond R6 OIBIX 6/30/2021

Fund Incep Date: Benchmark: Category: Net Assets: Manager Name: Manager Start Date: Expense Ratio: Expense Rank:

01/27/2012 ML Global Broad Market Index World Bond $2,417.00M Hemant Baijal 01/28/2013 0.62% 38

PORTFOLIO COMPOSITION (Holdings-based) INVESTMENT OVERVIEW

Assets The investment seeks total return. The fund invests mainly in debt securities of foreign government and corporate issuers. Under normal market conditions, it

invests at least 80% of its net assets (plus borrowings for investment purposes) in debt securities, and in derivatives and other instruments that have economic

Cash 64.28% characteristics similar to such securities. The fund typically invests in at least three countries other than the United States. It invests in debt securities of issuers in

US Stocks 0.00% both developed and emerging markets throughout the world. It is non-diversified.

US Bonds 0.18%

Non-US Stocks 0.00%

Preferred Stocks 0.00% PERFORMANCE

Convertible Bonds 0.60%

Other 1.89% 3 Year Rolling Performance (Jul 16-Jun 21)

Non-US Bonds 33.05% 6

5th to 25th Percentile

4 25th to Median

Median to 75th Percentile

Credit Quality (%) 2 75th to 95th Percentile

AAA 32.23%

AA 0.89% 0 Invesco International Bond R6

ML Global Broad Market Index

A 1.09%

BBB 26.08% -2

BB 23.20%

B 7.32% -4

Below B 4.47%

NR/NA 4.73% -6

Total: 100.01%

-8

4/2016 2/2017 4/2017 2/2018 4/2018 2/2019 4/2019 2/2020 4/2020 2/2021

3M YTD 1Y 3Y 5Y 7Y 10Y SI

Fund 0.07 -6.61 5.14 / 50 3.26 / 68 3.05 / 34 2.31 / 25 2.18 / 46 2.55

Sector (%)

Benchmark 1.31 -3.52 1.57 / 92 4.04 / 51 2.20 / 66 1.88 / 40 2.12 / 47

% Government 25.59%

% Municipal 0.00% Peer Group Median 1.29 -2.68 4.98 / 50 4.08 / 50 2.74 / 50 1.81 / 50 1.91 / 50

% Corporate 5.34% Number of Funds 64 58 54 52 46

% Securitized 2.70% CALENDAR 2020 2019 2018 2017 2016 2015 2014 2013 2012

% Cash and Equivalent 21.72% Fund 8.47 10.05 -5.53 11.12 6.79 -3.31 0.77 -3.88 11.29

% Derivative 44.65%

Benchmark 8.94 6.85 -1.09 6.95 2.17 -2.75 1.29 -2.65 4.25

Total: 100.00%

Peer Group Median 8.57 6.91 -2.68 8.67 2.59 -4.69 0.40 -2.91 7.42

RISK & PERFORMANCE STATISTICS NOTES

Peer Group

3 Yr Fund Benchmark

ASSET LOADINGS (Returns-based) Median

Alpha -1.76 0.00 0.13

FUND EXPOSURES (WEIGHT) (Jul 18-Jun 21) Beta 1.64 1.00 1.09

100

75 R-Squared 31.37 100.00 57.73

Sharpe Ratio 0.21 0.62 0.49

50

25 Up Market Capture 140.07 100.00 108.61

0 Down Market Capture 184.31 100.00 107.82

Current Average

Fund Bmk Fund Bmk 5 Yr Fund Benchmark Peer Group

Cash 0.0 0.0 3.5 3.5 Median

Credit Bond 0.0 11.5 3.1 26.5 Alpha 0.86 0.00 0.55

Govt Bond 0.0 37.6 0.0 37.2 Beta 1.38 1.00 1.10

HY Corp Bond 100.0 15.1 91.4 10.6 R-Squared 33.79 100.00 64.22

MBS 0.0 0.0 2.1 6.2 Sharpe Ratio 0.23 0.25 0.33

Muni Bond 0.0 0.0 0.0 0.0 Up Market Capture 143.73 100.00 111.31

TIPS 0.0 35.9 0.0 16.0 Down Market Capture 141.51 100.00 111.33

Page 47