Page 109 - AugDefComp

P. 109

MassMutual High Yield I MPHZX 6/30/2021

Fund Incep Date: Benchmark: Category: Net Assets: Manager Name: Manager Start Date: Expense Ratio: Expense Rank:

03/01/2011 Merrill Lynch High Yield U.S. Master High Yield Bond $544.00M Sean M. Feeley 12/03/2010 0.53% 25

PORTFOLIO COMPOSITION (Holdings-based) INVESTMENT OVERVIEW

Assets The investment seeks to achieve a high level of total return, with an emphasis on current income, by investing primarily in high yield debt and related securities.

The fund invests primarily in lower rated U.S. debt securities, including securities in default. It invests at least 80% of its net assets (plus the amount of any

Cash 2.74% borrowings for investment purposes) in lower rated fixed income securities (rated below Baa3 by Moody's, below BBB- by Standard & Poor's or the equivalent by

US Stocks 0.00% any NRSRO (using the lower rating) or, if unrated, determined to be of below investment grade quality by the fund's subadviser.

US Bonds 79.36%

Non-US Stocks 0.46%

Preferred Stocks 0.00% PERFORMANCE

Convertible Bonds 1.38%

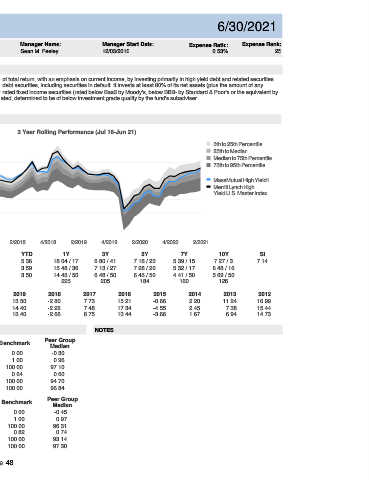

Other 0.00% 3 Year Rolling Performance (Jul 16-Jun 21)

Non-US Bonds 16.06% 12

5th to 25th Percentile

10 25th to Median

Median to 75th Percentile

8 75th to 95th Percentile

Credit Quality (%)

AAA 0.00% 6

AA 0.00% MassMutual High Yield I

A 0.00% 4 Merrill Lynch High

Yield U.S. Master Index

BBB 1.56%

BB 30.05% 2

B 39.54%

0

Below B 27.40%

NR/NA 1.45% -2

Total: 100.00%

-4

4/2016 2/2017 4/2017 2/2018 4/2018 2/2019 4/2019 2/2020 4/2020 2/2021

3M YTD 1Y 3Y 5Y 7Y 10Y SI

Fund 3.47 5.36 18.04 / 17 6.80 / 41 7.18 / 23 5.39 / 15 7.27 / 3 7.14

Sector (%)

Benchmark 2.75 3.59 15.48 / 36 7.13 / 27 7.28 / 20 5.32 / 17 6.48 / 16

% Government 0.00%

% Municipal 0.00% Peer Group Median 2.53 3.50 14.43 / 50 6.48 / 50 6.45 / 50 4.41 / 50 5.69 / 50

% Corporate 97.25% Number of Funds 225 205 184 160 126

% Securitized 0.00% CALENDAR 2020 2019 2018 2017 2016 2015 2014 2013 2012

% Cash and Equivalent 2.75% Fund 4.92 13.50 -2.80 7.73 15.21 -0.66 2.20 11.24 16.99

% Derivative 0.00%

Benchmark 6.20 14.40 -2.26 7.48 17.34 -4.55 2.45 7.38 15.44

Total: 100.00%

Peer Group Median 5.32 13.40 -2.66 6.75 13.44 -3.66 1.67 6.94 14.73

RISK & PERFORMANCE STATISTICS NOTES

Peer Group

3 Yr Fund Benchmark

ASSET LOADINGS (Returns-based) Median

Alpha -0.17 0.00 -0.30

FUND EXPOSURES (WEIGHT) (Jul 18-Jun 21) Beta 0.97 1.00 0.96

100

75 R-Squared 97.63 100.00 97.10

Sharpe Ratio 0.61 0.64 0.60

50

25 Up Market Capture 99.67 100.00 94.70

0 Down Market Capture 103.60 100.00 96.84

Current Average

Fund Bmk Fund Bmk 5 Yr Fund Benchmark Peer Group

Cash 0.0 0.0 0.2 0.0 Median

Credit Bond 0.0 0.0 0.0 0.0 Alpha 0.07 0.00 -0.45

Govt Bond 0.0 0.0 0.0 0.0 Beta 0.97 1.00 0.97

HY Corp Bond 93.2 99.4 94.2 99.7 R-Squared 97.08 100.00 96.31

MBS 0.0 0.0 0.0 0.0 Sharpe Ratio 0.82 0.82 0.74

Muni Bond 6.8 0.6 5.7 0.3 Up Market Capture 100.17 100.00 93.14

TIPS 0.0 0.0 0.0 0.0 Down Market Capture 102.29 100.00 97.30

Page 48