Page 110 - AugDefComp

P. 110

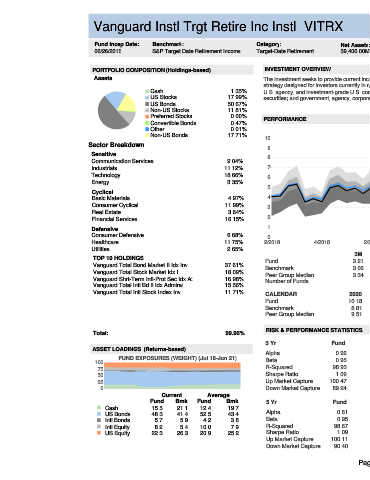

Vanguard Instl Trgt Retire Inc Instl VITRX 6/30/2021

Fund Incep Date: Benchmark: Category: Net Assets: Manager Name: Manager Start Date: Expense Ratio: Expense Rank:

06/26/2015 S&P Target Date Retirement Income Target-Date Retirement $9,406.00M William A. Coleman 06/26/2015 0.09% 2

PORTFOLIO COMPOSITION (Holdings-based) INVESTMENT OVERVIEW

Assets The investment seeks to provide current income and some capital appreciation. The fund invests in other Vanguard mutual funds according to an asset allocation

strategy designed for investors currently in retirement. Its indirect bond holdings are a diversified mix of short-, intermediate-, and long-term U.S. government,

Cash 1.35% U.S. agency, and investment-grade U.S. corporate bonds; inflation-protected public obligations issued by the U.S. Treasury; mortgage-backed and asset-backed

US Stocks 17.99% securities; and government, agency, corporate, and securitized investment-grade foreign bonds issued in currencies other than the U.S. dollar.

US Bonds 50.67%

Non-US Stocks 11.81%

Preferred Stocks 0.00% PERFORMANCE

Convertible Bonds 0.47%

Other 0.01% 3 Year Rolling Performance (Jun 18-Jun 21)

Non-US Bonds 17.71% 10

Sector Breakdown 5th to 25th Percentile

9 25th to Median

Sensitive 8

Communication Services 9.04% Median to 75th Percentile

Industrials 11.12% 7 75th to 95th Percentile

Technology 18.66%

6 Vanguard Instl Trgt

Energy 3.35%

5 Retire Inc Instl

Cyclical S&P Target Date

Basic Materials 4.97% 4 Retirement Income

Consumer Cyclical 11.99% 3

Real Estate 3.64%

Financial Services 16.15% 2

Defensive 1

Consumer Defensive 6.68% 0

Healthcare 11.75% 2/2018 4/2018 2/2019 4/2019 2/2020 4/2020 2/2021

Utilities 2.65%

3M YTD 1Y 3Y 5Y 7Y 10Y SI

TOP 10 HOLDINGS

Fund 3.21 3.32 12.04 / 53 8.12 / 39 6.70 / 49 6.07

Vanguard Total Bond Market II Idx Inv 37.61%

Benchmark 3.06 3.09 11.12 / 63 7.44 / 66 6.29 / 63 5.15 / 48 5.42 / 53

Vanguard Total Stock Market Idx I 18.09% Peer Group Median 3.34 3.66 12.97 / 50 7.97 / 50 6.68 / 50 5.09 / 50 5.53 / 50

Vanguard Shrt-Term Infl-Prot Sec Idx Adm 16.98%

Number of Funds 37 35 32 25 23

Vanguard Total Intl Bd II Idx Admiral 15.56%

Vanguard Total Intl Stock Index Inv 11.71% CALENDAR 2020 2019 2018 2017 2016 2015 2014 2013 2012

Fund 10.18 13.20 -1.98 8.54 5.29

Benchmark 8.81 13.33 -2.54 8.54 5.01 -0.18 4.86 6.28 7.51

Peer Group Median 9.51 13.16 -2.94 8.73 5.25 -0.65 4.52 6.15 8.96

RISK & PERFORMANCE STATISTICS NOTES

Total: 99.96%

Peer Group

3 Yr Fund Benchmark

ASSET LOADINGS (Returns-based) Median

Alpha 0.92 0.00 0.57

FUND EXPOSURES (WEIGHT) (Jul 18-Jun 21) Beta 0.95 1.00 1.01

100

75 R-Squared 98.93 100.00 96.55

Sharpe Ratio 1.09 0.94 1.01

50

25 Up Market Capture 100.47 100.00 101.14

0 Down Market Capture 89.24 100.00 97.79

Current Average

Fund Bmk Fund Bmk 5 Yr Fund Benchmark Peer Group

Cash 15.5 21.1 12.4 19.7 Median

US Bonds 48.3 41.4 52.5 43.4 Alpha 0.61 0.00 0.27

Intl Bonds 5.7 5.9 4.2 3.8 Beta 0.95 1.00 1.00

Intl Equity 8.2 5.4 10.0 7.9 R-Squared 98.67 100.00 96.36

US Equity 22.3 26.3 20.9 25.2 Sharpe Ratio 1.09 0.97 1.01

Up Market Capture 100.11 100.00 101.03

Down Market Capture 90.40 100.00 97.63

Page 49