Page 53 - NovDefComp

P. 53

Q3 2020 Market Review

Q3 2020 Market Review

SUMMARY TRAILING RETURNS (9/30/2020)

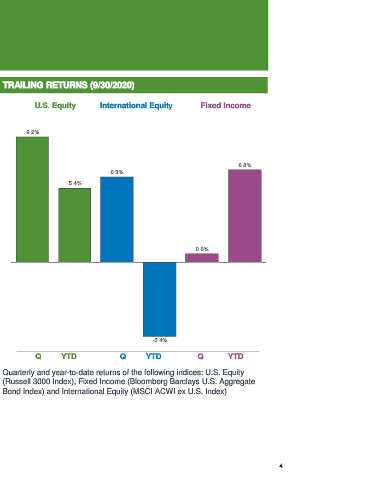

• U.S. equity markets moved higher, up 9.2% (Russell U.S. Equity International Equity Fixed Income

3000) in the third quarter as the economy continued to

recover and markets benefitted from significant fiscal 9.2%

and monetary stimulus.

• International equities rose to a lesser extent, posting a 6.8%

6.3% gain over the quarter (MSCI ACWI ex U.S.). 6.3%

5.4%

• The broad U.S. fixed income market delivered a

modest 0.6% gain for the quarter (Bloomberg Barclays

Aggregate) as interest rates stabilized at low levels.

• After hitting 14.7% unemployment in April, the U.S. 0.6%

labor market continued to improve during the third

quarter with September unemployment dropping

to 7.9%.

• Growth stocks continued their outperformance with the

Russell 1000 Growth outperforming the Russell 1000

Value by over seven percentage points this quarter.

-5.4%

• The Federal Reserve kept rates at nearly zero during Q YTD Q YTD Q YTD

the quarter and signaled their expectation of rates

remaining at these levels for the next few years. Quarterly and year-to-date returns of the following indices: U.S. Equity

(Russell 3000 Index), Fixed Income (Bloomberg Barclays U.S. Aggregate

Bond Index) and International Equity (MSCI ACWI ex U.S. Index)

4