Page 55 - NovDefComp

P. 55

Q3 2020 Market Review – U.S. Equity

Q3 2020 Market Review - U.S. Equity

U.S. EQUITY

• The broad U.S. equity market, as measured by the Russell 3000 Index, was up 9.2% for the quarter.

• The best performing U.S. equity index for the quarter was Russell 1000 Growth, returning a positive 13.2%.

• The worst performing U.S. equity index for the quarter was Russell 2000 Value, returning a positive 2.6%.

INDEX PERFORMANCE (sorted by trailing quarterly performance) GROWTH VS. VALUE

50% Grow th Outperforms

40% 37.5%

40%

30%

30%

20% 15.7%

13.2% 15.0% 20%

10% 9.2% 7.2% 5.6% 10%

2.6%

0% 0%

-10% -5.0% 10%

-20% -14.9% 20% Value Outperforms

QTR 1 Yr QTR 1 Yr QTR 1 Yr QTR 1 Yr QTR 1 Yr 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

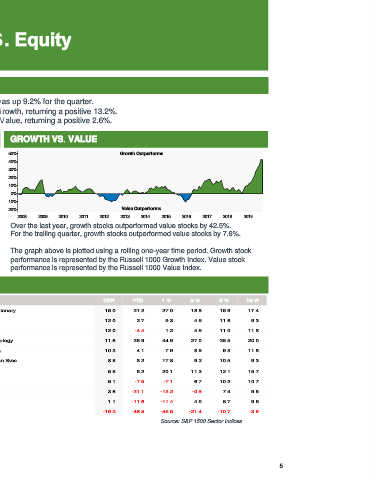

QTR YTD 1 Yr 3 Yr 5 Yr 10 Yr Over the last year, growth stocks outperformed value stocks by 42.5%.

Russell 1000 Growth 13.2 24.3 37.5 21.7 20.1 17.3 For the trailing quarter, growth stocks outperformed value stocks by 7.6%.

Russell 3000 9.2 5.4 15.0 11.6 13.7 13.5

Russell 2000 Growth 7.2 3.9 15.7 8.2 11.4 12.3 The graph above is plotted using a rolling one-year time period. Growth stock

Russell 1000 Value 5.6 -11.6 -5.0 2.6 7.7 9.9 performance is represented by the Russell 1000 Growth Index. Value stock

Russell 2000 Value 2.6 -21.5 -14.9 -5.1 4.1 7.1 performance is represented by the Russell 1000 Value Index.

SECTOR (sorted by trailing quarterly performance)

QTR YTD 1 Yr 3 Yr 5 Yr 10 Yr

15.0% Consumer Discretionary 15.0 21.2 27.0 18.8 15.9 17.4

12.0% Materials 12.0 2.7 9.3 4.5 11.6 9.3

12.0% Industrials 12.0 -4.4 1.2 4.5 11.0 11.8

11.6% Information Technology 11.6 26.9 44.9 27.0 26.5 20.0

10.3%

Consumer Staples 10.3 4.1 7.9 8.9 9.3 11.8

8.8%

Telecommunication Svcs. 8.8 8.2 17.8 9.2 10.5 9.3

5.8%

Health Care 5.8 5.2 20.1 11.3 12.1 15.7

5.1%

Utilities 5.1 -7.5 -7.1 6.7 10.2 10.7

3.6%

Financials 3.6 -21.1 -13.2 -0.8 7.4 9.5

1.1%

Real Estate 1.1 -11.6 -11.4 4.0 6.7 9.5

-19.2%

Energy -19.2 -48.5 -45.5 -21.4 -10.7 -3.9

-20.00 -15.00 -10.00 -5.00 0.00 5.00 10.00 15.00

Source: S&P 1500 Sector Indices

5