Page 58 - NovDefComp

P. 58

Q3 2020 Market Review – Fixed Income

Q3 2020 Market Review - Fixed Income

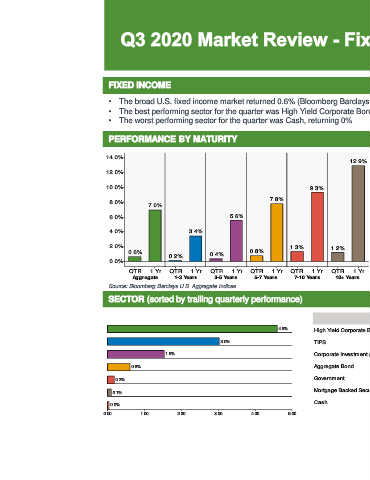

FIXED INCOME

• The broad U.S. fixed income market returned 0.6% (Bloomberg Barclays U.S. Aggregate) for the quarter.

• The best performing sector for the quarter was High Yield Corporate Bond, returning a positive 4.6%.

• The worst performing sector for the quarter was Cash, returning 0%

PERFORMANCE BY MATURITY YIELD CURVE

3.0

14.0% 3.0

12.9% 2.5

12.0% 2.5

2.0

10.0% 9.3%

2.0

7.8% 1.5

8.0%

7.0%

1.5

6.0% 5.6% 1.0

1.0

4.0% 3.4% 0.5

2.0% 1.3% 1.2% 0.5 0.0

0.6% 0.8%

0.2% 0.4% Qtr 1 Yr 5 Yrs 10 Yrs 20 Yrs 30 Yrs

0.0% 0.0

QTR 1 Yr QTR 1 Yr QTR 1 Yr QTR 1 Yr QTR 1 Yr QTR 1 Yr Qtr 1 Yr 5 Yrs 10 Yrs 20 Yrs 30 Yrs

A ggregate 1-3 Years 3-5 Years 5-7 Years 7-10 Years 10+ Years

Yield Curve - Current One Year Ago

Source: Bloomberg Barclays U.S. Aggregate Indices

Yield Curve - Current One Year Ago

SECTOR (sorted by trailing quarterly performance)

QTR YTD 1 Yr 3 Yr 5 Yr 10 Yr

4.6% High Yield Corporate Bond 4.6 0.6 3.3 4.2 6.8 6.5

3.0% TIPS 3.0 9.2 10.1 5.8 4.6 3.6

1.5% Corporate Investment Grade 1.5 6.6 7.9 6.4 6.0 5.1

0.6% Aggregate Bond 0.6 6.8 7.0 5.2 4.2 3.6

0.2% Government 0.2 8.8 8.0 5.5 3.7 3.1

0.1% Mortgage Backed Securities 0.1 3.6 4.4 3.7 3.0 3.0

Cash 0.0 0.6 1.1 1.7 1.2 0.6

0.0%

0.00 1.00 2.00 3.00 4.00 5.00

Source: Bloomberg Barclays U.S. Indices

7